Leading Mobile Wallet Services Developer in Zimbabwe

Get expert solutions for eMoney development and launch from Nyeredzi Global Pvt. With our partners across the world, and servers in South Africa, AWS, the server uptown time is always plus 99%. Schedule a free consultation today and get started. Leverage our expertise to develop an ePayment solution for your business. Don’t let your busy schedule stand in your way. At Nyeredzi Global Pvt, we are the leading mobile wallet services developer in Zimbabwe.

Due to digitalization, most companies are working towards implementing cutting-edge solutions in their businesses. Nowadays, a person must get their money without hustles. This can only be achieved by having systems that allow people to transact from anywhere at anytime. Also, just like Ecocash mobile wallet and other mobile wallets, Zimbabwe has many untapped opportunities in the market.

Mobile Wallets for Retail Companies in Zimbabwe

Mobile wallet solutions remains viable in developing economies across the globe. They can be utilized by every business with access to customers. When we talk of customers, we mean businesses that serve B2C. Thus, from companies in retail, fuel station, food outlets, etc. having a mobile wallet is huge business that remains viable in Zimbabwe and Africa.

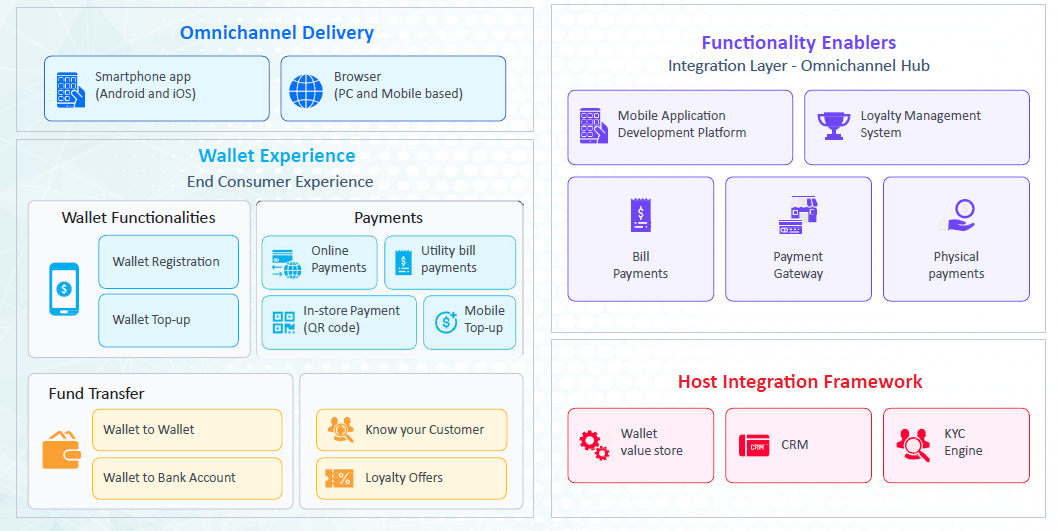

Gone are the days when people used to wake up and queue to collect money sent by loved ones. At Nyeredzi Global Pvt, we have a fully fleshed mobile wallet system ready for implementation. The mobile wallet is designed in such a way that it has several currency options and some variations.

How does the mobile wallet work?

A mobile wallet gives flexibility to customers to bank without opening a bank account (mobile banking). Having a phone is enough for a person to have money in a wallet. The mobile wallets can be used with a WIFI connection or using USSD dial. A user doesn’t need to be computer literate for them to have a mobile wallet account. After registering a phone number and submitting an ID, a user can be registered for the mobile wallet account.

Features on the Mobile Wallet

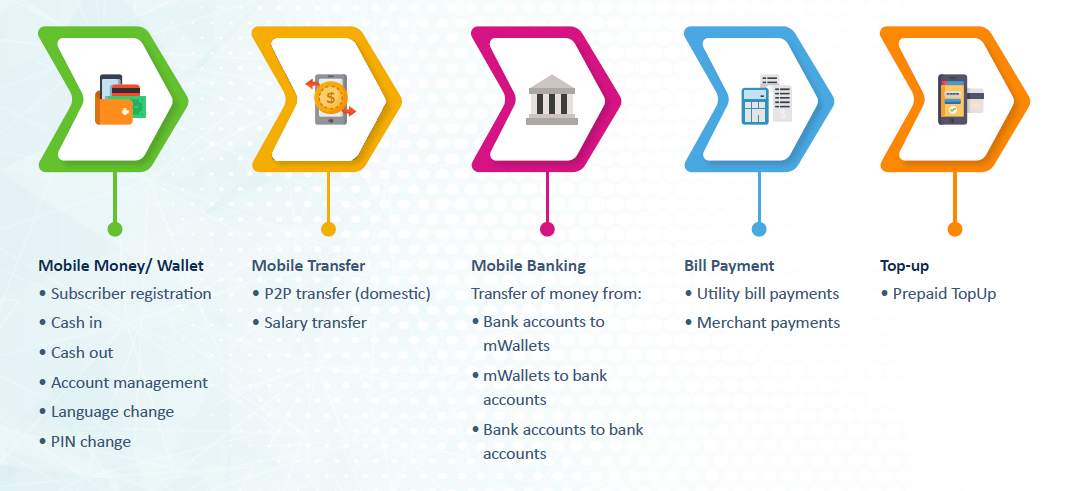

The mobile wallet application has many functionalities to make it a usable system. Therefore, a user can use the mobile wallet for the following things:

- Airtime Top

- School Fees payment

- DSTV payment

- Account to Account transfer

- Utility bills payment

- Bus card top up

- Cash In and Cash Out

- Mobile Wallet to Bank Transfer

- Etc.

All these functionalities are a necessity as they are the basic things needed everyday. Of course, not all of them can be a daily thing, but the majority can be done frequently and easily with the use of a mobile wallet.

Other mobile wallet usage

Apart from the above mentioned usages. A mobile wallet can be used by unbanked customers. Those customer who don’t qualify or meet the banking needs. A bank requires many KYC documents, of which the majority of the population in developed countries are not able to provide. Therefore, a mobile wallet can be used. The mobile wallet can be used to give micro loans via phone applications and disbursements.